- Call 516-721-0609

- E-Mail: agallo@ajgcapitalresources.com

Anthony Galeotafiore

Stefan JungeJuly 18, 2019

Anthony Galeotafiore grew up in Bethpage, Long Island, New York. He attended Fordham University from 1991-95. He studied Political Science. After graduation, he landed his first job at a New York stock exchange investment firm. The firm taught him how to assess risk and reward in business.

By 1997 Anthony Galeotafiore had gained enough experience and confidence to strike out on his own. He founded AJG Capital, a Long Island-based real estate investment firm seeking out value-added opportunities in the local real estate market. Over the years he gained experience from all sides of the deal, as a lender, developer, principal, and consultant.

The culmination of experience allowed him to find opportunities, in a wide variety of asset classes. Some of those opportunities are in distressed real estate, commercial mortgages. Industrial properties, offices and mixed-use properties and on occasion, residential homes. AJG Capital has a proven track record of acquiring land and designing and building residential properties from the ground up.

Anthony Galeotafiore’s most recent projects include the Harborview State Condominiums which is a 40 unit waterfront property. It is a community for residents 55 and over. It is located on the south shore of Long Island. The Parkview Salsbury is a 30 unit 55 and over community that was completed in Westbury, Long Island. He also developed a small condominium project in the heart of Westbury. It is a four-story townhouse condominium project which was built and very quickly sold out.

Where did the idea for AJG Capital come from?

I was in the lending business. People would come to me with opportunities whether they were looking for money or had a project where they needed funding. It always kept me in the deal flow. In 1997 I decided to take on some of these deals as a developer and in some cases a lender. That was on the commercial and residential side. Because I was in the deal flow, the opportunities came across my desk.

What does your typical day look like and how do you make it productive?

My typical day starts at 7 a.m. when I meet with my project managers. We go over the goals for the day, the week, and the month. We go over the inspections that have to be done. We address issues that have come up and plan a solution. By 10 a.m. I am making calls to the brokers that handle the sales to see where we are with prospective buyers. I spend time with my attorneys to see what negotiating may be left on any deals that I may be working on. The rest of the day is spent reaching out to brokers to look at potential deals going forward.

How do you bring ideas to life?

The way I bring ideas to life is by writing down a clear plan and we follow the plan step by step. Each day, we take baby steps towards that plan. I try to keep it simple.

What’s one trend that excites you?

The one trend that excites me in real estate development is the downtown redevelopment plan taking place on Long Island. Over the past decade, many of the downtown areas that were struggling, have a new excitement to revitalize. The towns are on board with it and the communities are on board with it. It is exciting to me because I look to make investments in downtowns that need revitalization. You tend to get a lot of support, a lot more appreciation, and you get a lot more done.

What is one habit of yours that makes you more productive as an entrepreneur?

One habit of mine that makes me more productive is time management. Time management is really important. I think a lot of people waste a lot of time. I rarely take meetings unless it is absolutely necessary. I try to make my phone calls and emails very quickly. If a meeting is necessary, I get right to the point so that the other side knows exactly where I’m coming from and exactly what I’m looking for. Time management is critical to being productive as an entrepreneur.

What advice would you give your younger self?

I would tell my younger, Anthony Galeotafiore to keep to the basics. Accomplish one thing at a time. Do one thing and become successful. Then complete it, make money on it, and then move on to the next.

Tell us something that’s true that almost nobody agrees with you on.

One thing that I know to be true is that real estate is not an easy business. People that see what I do think it is glamorous, and it looks easy and it looks fun, and it is all of that. But it is an extremely difficult business. It is very capital intensive. It is high risk because most of the deals that I go into take from 2-5 years to complete. When projects take that long it increases the market risk. I have this debate with many people. They think what I do is very easy, but it is not.

As an entrepreneur, what is the one thing you do over and over and recommend everyone else do?

The one thing that I do first thing in the morning is to make a to-do list. I would recommend that as soon as you get to your desk and to do this every day and every week. As you complete each task on mark it off the list.

What is one strategy that has helped you grow your business?

One of the business strategies that I always employ is to look where you can add value. It is not just a business strategy, I do this with employees, business contacts, friends, or family. I have always tried to demonstrate how I can be an asset. I don’t go into deals looking at what I can get from everyone else. I try to show how I can be an asset to everyone else. I know that has helped to grow my business over the years.

What is one failure you had as an entrepreneur, and how did you overcome it?

During the 2008 financial crisis, I allowed myself to get over-extended. I took-on more deals than I should have. As a result, when the market turned, I lost all of my equity. The way I overcame it was I took every phone call from investors, from lenders, from contractors and paid everybody every dollar they were owed, and I kept them in the loop. I was direct with everybody. I laid all my cards on the table. People continued to work with me until I worked my way back to where I am today.

What is one business idea that you’re willing to give away to our readers?

One idea for a business would be to have a real estate developer’s one-stop-shop of consulting. They would offer construction management with cost analysis, and a bidding process for the developer, AIA Requisition services and payroll services. This consultant should be able to handle all these aspects for a developer.

What is the best $100 you recently spent? What and why?

On the professional side, I gave one of my employees an unexpected gift card to take his wife out to dinner. I try to do this because it goes a long way. I want my employees to know that they are being recognized and appreciated. In turn, I get a lot more production going forward.

What is one piece of software or a web service that helps you be productive?

Costar is a real estate listing service. It provides me with properties that are available along with ownership information. It also provides comparable sale listings and expense analysis. I also use google maps. I use it to view properties if a broker calls and asks me to take a look at a property. I use the street view to get a sense of the property. It saves me a lot of time. Sometimes I don’t even have to physically go there.

What is the one book that you recommend our community should read and why?

The Intelligent Investor by Benjamin Graham. It is a great book for anyone who wants to invest.

What is your favorite quote?

Some people question and ask why. I question and ask why not.

Key Learnings:

- Be an asset to everyone, always look where you can add value.

- The most important thing to do first thing in the morning is to make a to-do list.

- Don’t go into deals looking at what I can get from everyone else.

Source: Ideamensch.com

Anthony Galeotafiore on the Pros and Cons and Real Estate Development

BY JOHANNA BREENJULY 15, 2019

People are aware that real estate development is an investment vehicle that has a huge potential for staggering profits, but they also realize that there are risks as well.

To learn about the pros and cons of real estate investment, we spoke with Anthony Galeotafiore. Galeotafiore is an experienced real estate professional who has worked in the real estate field as a developer, lender, dealer, and consultant. His current focus is on non-performing commercial mortgages in New York and Florida, and his company, AJG Capital Group, also designs and builds residential and commercial real estate projects.

What is Real Estate Development?

According to Galeotafiore, real estate development often involves taking raw land and bringing everything together to turn that raw land into either residential, industrial, or commercial real estate. Real estate development can also involve the refurbishment of existing buildings to be leased at a higher price. Some types of real estate development are less risky for investors, while others have a higher risk.

How Do You Make Money in Real Estate Development?

The key to making money investing in real estate development is to work with a savvy developer who has great ties within their area of expertise in their field. Developers are like producers of movies. They need to have extensive professional contacts in their field to see a project through to completion.

For example, a developer must work in concert with architects, engineers, surveyors, city planning departments, contractors, leasing companies and lawyers to turn a raw piece of land into a shopping mall, residential neighborhood or factory.

Developers need to have the skills to work with all of these real estate professionals as they finance and buy land, decide the best build-out end result, work with architects to design the project they envision, obtain the required building permits, supervise the construction, and then decide whether to rent or sell their development.

The best developers are creative problem-solvers who don’t mind taking some well-calculated risks. They also can forge and maintain strong relationships with a team of other professionals who will help them carry out their plans.

Pros

High Rewards:

One of the greatest pros of developing real estate is that the rewards can be incredibly high. Over a few years, the developer will have taken raw land and turned it into a housing development or shopping center. Then, the developer can sell the homes or shopping center for a handsome profit or rent or lease out the buildings and spaces.

One Can Minimize Risk:

It is not true that all real estate development is risky. In fact, some types of real estate development carry a high yield with low risk.

A good example of a high yield/low-risk development would be a “build-to-suit” project. A good example of a build-to-suit project would be a McDonald’s franchise location. The developer needs to secure the location that will be approved by the local planning department and obtain the building contractors, but they will get all of the building plans from McDonald’s. There is little risk that, at the project’s completion, McDonald’s won’t lease the space for a long term because it was exactly what they ordered built. Also, the contracts in such build-to-suit agreements leave little room for companies to back out of their lease upon project completion.

Another real estate development with lower risk is a planned housing development. This is less risky as long as the developer has adequately assessed the need in the area for homes in the target price range. The reason this type of development is less risky is that building contractor specialists can move from house to house within the development, completing each part in stages. Housing developments are also becoming easier and cheaper to produce because of pre-manufactured materials. They are far more prevalent and of far better quality today than in the past.

Cons

Longer Time to Achieve Profits:

Unlike investing in a home that one can immediately rent out to a tenant, real estate development takes longer to achieve a profit. The land must be purchased, permits granted, the building completed, and spaces leased. Real estate developers and investors must have the stamina to wait for the profits to be realized.

Because of the latency period in accruing profits, investors who do not desire or cannot wait for profits from a completed project are advised to consider investing in real estate developments through real estate mutual funds and real estate exchange-traded funds. Both of these vehicles work with many developments simultaneously, offering a more regular return on investment.

Complications:

Because of the number of steps involved in a real estate development project, complications can and will often occur. Examples of complications that have to be solved by developers include problems in acquiring permits, legal conflicts with nearby landowners, and delays in the building process. Savvy developers have considered and worked through the many hurdles and steps in a project well before the land is purchased. They are experts in their local area and consult with the best partners to navigate around the shoals that could break a project on the rocks.

Anthony Galeotafiore reminds us that investing in real estate development has the potential for extremely high yields. It is important to realize, though, that these are longer-term investments. Investors need to choose a developer wisely who has proven to be able to assemble and manage a highly professional and competent team. The developer needs to have the requisite skills to predict and navigate around all types of complications in advance as well as the skill set to know how to choose prudent projects in the region and market.

Source: Praguepost.com

Bethpage Developer Anthony Galeotafiore Breaks Ground on Luxury Rental Project in Bayshore

BETHPAGE, NY / ACCESSWIREJuly 26, 2019

Last year Long Island Real Estate Developer Anthony Galeotafiore and his company AJG Capital has purchased the site at 64 Park Avenue in Bay Shore, New York with the intention of securing site plan approval from the Town of Islip to build a luxury mixed use rental property known as Park Avenue Lofts. The highly anticipated project received site plan approval in November of 2018. Immediately following, Anthony Galeotafiore worked expeditiously with his team to secure the building permits from the Town of Islip. After much back and forth to get the project right, Galeotafiore has recently secured building permits in July 2019. After a beautiful ground breaking ceremony, the Park Avenue Lofts project is now underway. According to Anthony Galeotafiore, the building will be up and ready to be rented by April 2020 – “we are so excited to be a part of the rapid redevelopment that is taking place in Bay Shore,“ commented Galeotafiore.

Bay Shore has been going through a rapid transformation like many of the Downtowns on Long Island. Park Avenue Loft sits 50 yards away from the Bay Shore LIRR Train station so it will certainly appeal to those looking to commute into Manhattan. Given that the property sits right in the mix of the bustling Downtown of Bay Shore it appeals to people who are looking for a lifestyle where they can walk out of their apartment and be in the middle of restaurants, cafes, bars, and entertainment. According to Galeotafiore, the completion of the project will be by the early part of 2020. Galeotafiore looks to invest in areas in Long Island that are on the brink of revitalizing. The Park Avenue Lofts project fits that exact criteria.

There will be a mix of unit sizes from studios, 1 bedroom and 2 bedroom units all with modern finishes and amenities, gourmet granite kitchens with stainless steel appliances with a modern look and feel. For more information go to www.AJGCapitalGrp.com or call 516-933-4002.

Source: Accesswire.com

Is Investing in Real Estate Safe and Profitable? Anthony Galeotafiore Weighs In

Anthony GaleotafioreJul 24, 2019

Real estate investing is one of the pillars of the investment world alongside stocks, bonds, and commodities. Each of those carries varying levels of risk, though real estate throws some additional wrenches into the equation by being far less liquid than other investments and requiring the investment to be actively managed.

Due to those added wrinkles, real estate investing does have one of the most attractive risk/reward profiles of any investment according to Anthony Galeotafiore, a real estate developer, investor and consultant from Bethpage, New York. The Founder and CEO of AJG Capital Group adds that real estate investments can also be highly leveraged, allowing the investor to start generating sizable income almost immediately from a modest initial investment.

So while the annual income generation from real estate may not be much greater as a percentage of the overall value of the property than a high-yield dividend stock or REIT is compared to the overall value of the shares (with 5–10% being a solid rate), the fact that real estate can be highly leveraged means the income can amount to 40–50% or more of the initial investment compared to that same 5–10% rate for stocks.

That income can then be reinvested into additional properties using the same leverage tactics, allowing an investor to begin building a sizable real estate portfolio that is appreciating in value and essentially paying for itself even as it’s producing steady streams of income.

Needless to say, real estate investing can prove to be very profitable very quickly with the right approach.

How Safe is Real Estate Investing?

When considering the long-term history of the overall real estate market, investing in property also appears to be quite safe. Since the end of World War II, the median price of a U.S home has jumped 80-fold, creating value comparable to the stock market, which has averaged annual returns of about 10% since 1950.

That said, Anthony Galeotafiore cautions that individual investments are always fraught with more risk than larger sample sizes. Just as investing in a single stock is highly risky regardless of what the overall market is projected to do, so too can an investment in a single property turn out poorly based on any number of factors, regardless of what the overall real estate market is likely to do.

Among the broad real estate risk factors is the state of the local market, which could be overcooked compared to the national average. Recent examples are Seattle and San Francisco, where home prices have flatlined over the past year after rapid growth. Buying into a market bubble could set the investment timeline back by months or even years.

Tenants also present an unknown risk factor for property investors, with bad ones potentially eating up resources and profits for months before they can be sent packing.

But the greatest risk is from the individual property itself and its suitability as a profitable long-term investment. The wrong property could be a money pit, requiring continual maintenance and upgrades to keep it competitive or complying with updated bylaws and standards which end up sapping its profit potential.

Source: Medium.com

Anthony Galeotafiore Completes and Sells Out a Long Island 55 and Over Waterfront Community

BETHPAGE, NY / ACCESSWIRE / July 22, 2019

Bethpage Developer Galeotafiore built and sold out Harborview Estates Condominium- the beautiful 55 and over waterfront community on the south shore of Long Island. The highly anticipated waterfront project has been sold out- and for good reason.

Real estate developer Anthony Galeotafiore (Bethpage) just completed the sale of the last of 40 units at Harbor View Estates Condominium, a 55 and over waterfront community located off South Great Neck Road in Copiague NY. The last few units will be delivered in August 2019. The community consists of 28 condo style units (approx. 1200SF) and12 duplex townhomes (2400 SF) a community building, boat slips, private elevators, bocce and horseshoe courts.

According to Galeotafiore the main driver of the high demand in this community has been the extremely low tax base. When asked about the project Galeotafiore commented “when we set out to start this project, I met with the tax assessor and confirmed what the tax base would be-they were extremely low we knew right then and there that we had a winner.” The rising cost of living on Long island is forcing many buyers, especially the 55 and over market to seek out places that have the lowest monthly cost to carry. It’s getting harder and harder to find areas on Long island with low taxes. Additionally, because the community is on the water, Galeotafiore offered an option of buying a boat slip with access to the Great South Bay- “We wanted to deliver a higher-end unit for the boating community at an affordable price.”

Harborview Estates Condominium sales were handled by Mary Macaluso, Licensed Associate Broker of Realty Connect USA and her team as the in-house sales for this project. Mary has been selling real estate for over 20 years and is extremely diligent with finding buyers exactly what they are looking for. She acknowledges that it has been getting more and more difficult to find beautiful living on Long Island where the taxes are affordable- Galeotafiore’s project has accomplished just that. We asked Mary what she enjoyed most of selling these units- “working with a developer like Anthony has been such a pleasure, he has been extremely accommodating and responsive to all the buyers’ requests- something that is difficult to find in the building industry.”

Galeotafiore is working on a number of other projects including a repositioning and renovation of an existing 31,000 SF office building in the heart of Amityville where he is looking to convert it to a luxury residential rental building to help spearhead the revitalization of the Amityville Downtown.

Source: Yahoo News

Bethpage Developer Galeotafiore Acquires Redevelopment Property in Bayshore

BETHPAGE, N.Y., May 18, 2018PRNewswire

Bethpage Real Estate Developer Anthony Galeotafiore and his company AJG Capital recently acquired the property located at 64 Park Avenue in Bayshore, New York. The demolition of the existing structures was completed in February 2018 and Galeotafiore has been in the process of seeking approvals from the Town of Islip to construct a 19 unit Mixed Use Luxury Rental Building, known as Park Avenue Lofts.

In recent years, Bayshore has been going through a tremendous amount of redevelopment much like many of the Downtowns on Long Island The property is a stone’s throw away from the Bayshore LIRR Train station making it an attractive place to live for those who commute into Manhattan. According to Galeotafiore, the full approvals to put a shovel in the ground are expected by June 1, 2018. Park Avenue Lofts will help fill the much needed demand for housing in the bustling Downtown of Bayshore. According to Galeotafiore, the completion of the project will be by the early part of 2019.

There will be a mix of unit sizes from studios, 1 bedroom and 2 bedroom units all with modern finishes and amenities, gourmet granite kitchens with stainless steel appliances with a modern look and feel. For more information go to www.AJGCapitalGrp.com or call 516-933-4002.

SOURCE: PR Newswire

Bethpage Developer Galeotafiore Commence Sales of Phase 2 for Harbor View Estates Condominium

NEW YORK, April 27, 2018PRNewswire

Real estate developer Anthony Galeotafiore(Bethpage) recently opened the sales center for Phase 2 of Harbor View Estates Condominium, a 40 unit waterfront 55 and over complex located off South Great Neck Road in Copiague NY The community consists of 28 Condominiums (approx. 1200SF) and 12 duplex townhomes (2400 SF) a community building, boat slips, private elevators, bocci and horseshoe courts.

According to Galeotafiore the sales for Phase 1 were strong for a number of reasons. The community offers luxury units at an affordable price. In todays booming market it is tough to find new construction with quality design in and around the $400,000.00 number. What really intrigued Galeotafiore to move forward with this project is the extremely low tax base. According to Galeotafiore, “when we were doing our due diligence on this property we realized what a burden Long Island real estate taxes can be on the 55 and over age group so we knew if we could offer a quality product and lifestyle with a very low tax base it would be a success.” Phase 2 sales opened a few weeks back and the community is already sixty five percent sold out.

and his company AJG Capital has partnered with Mary Macaluso, Licensed Associate Broker of Realty Connect USA and her team as the in-house sales for his projects. Mary brings over 20 years’ experience in the Real Estate Industry working with buyers and sellers across all markets. She prides herself on the relationships she builds within each community she serves. Mary was very excited to be part of the sales of Harbor View Estates-“Quality construction, location and low taxes seem to be the three most common reasons that our buyers decide to move into Harbor View Estates” because it is so hard to find luxury, waterfront living with a low tax base on Long Island, this community is very attractive to today’s 55 and over age group according to Macaluso.

has a number of other developments in the works, including the beautiful Park Avenue Lofts, a 19 unit Mixed Use Luxury apartment building located in the heart of the bustling downtown of Bayshore, New York.

SOURCE: PR Newswire

AJG Capital Completes Construction and Sales of Newton Gardens Condominium in the Heart of the Village of Westbury

BETHPAGE, N.Y., April 16, 2018PRNewswire

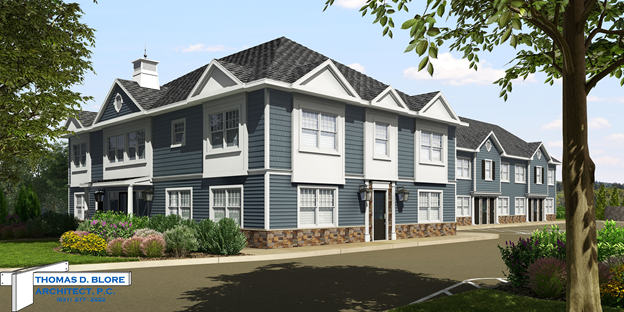

Long Island based real estate developer Anthony Galeotafiore and his company AJG Capital (www.ajgcapitalgrp.com), recently completed the construction of Newton Gardens Condominium (www.newtongardens.com) – a townhouse style condominium development located in the heart of the Village of Westbury. Each unit is a grand 4 story-architecturally stunning 2183 SF townhome which boast some of the most luxurious features, modern gourmet kitchens and are fully appointed with designer finishes, private balconies and a two car garage. The townhomes sold for around $500,000 each.

The units sold out fast primarily because of its prime location near the Long Island Railroad according to Galeotafiore. What excited Galeotafiore about the property was not only the great location but also a fully committed Village that is interested in the redevelopment of the Downtown- he continues, “When you get involved in a project within a Village that is so committed to the growth of the Downtown, you know you have a winner.” In a time where we are dealing with the red tape of municipalities, the process can be grueling. Galeotafiore thanks the people at the Village of Westbury Building Department and the Planning Board for making the process painless. “The Village of Westbury was great to us along the way,” according to Galeotafiore. “When you share the same vision in beautifying a neighborhood, it makes things that much easier.”

Galeotafiore and AJG has partnered with Mary Macaluso, Licensed Associate Broker of Realty Connect USA and her team as the in-house sales for his projects. Mary brings over 20 years’ experience in the Real Estate Industry working with buyers and sellers across all markets. She prides herself on the relationships she builds within each community she serves. Mary was very excited to be part of the gentrification of downtown Westbury. Luxury living in the heart of Westbury Village is very attractive to today’s millennial buyers. Millennials want to be close to transportation and entertainment according to Macaluso.

Galeotafiore has a number of other developments in the works, including the beautiful HarborView Estates Condominium, a 40 unit waterfront 55 and better community in Copiague, New York. The luxurious units have optional private elevators, boat slips, high end finishes and a recreational building. For more information go to www.harborviewestatescondo.com

SOURCE: PR Newswire

KoaWare Spotlight: Westbury, NY

Oct 28, 2016

Fall in the North East is second to none with the natural colors that vividly steal the spotlight. The warm yellows, orange, and red leaves contrasted with blue skies sets the stage for the perfect shot. This Westbury, New York townhouse boasts a clean, modern open floor plan, brilliantly designed kitchen, and lots of natural sunlight.

The home is co-listed by Gina Fiorenze and Mary Macaluso of Realty Connect. The Property Website was created by Explorify 3D, check it out here!